What is a Discounted Cash Flow (DCF) Analysis?

A discounted cash flow (DCF) analysis is a valuation technique used to estimate the value of a business.

In a DCF analysis, one calculates the present value of a business by taking an estimate of future free cash flows and discounting them to the present using a discount rate.

The purpose of using a discounted cash flow analysis is to determine the intrinsic value of a business. If a DCF analysis indicates that a business should be valued above its current price, then there may be an investment opportunity in buying the business at a discount from its perceived value.

How to Perform a Discounted Cash Flow Analysis

Running a discounted cash flow analysis is a multi-step process that requires several calculations.

Step 1

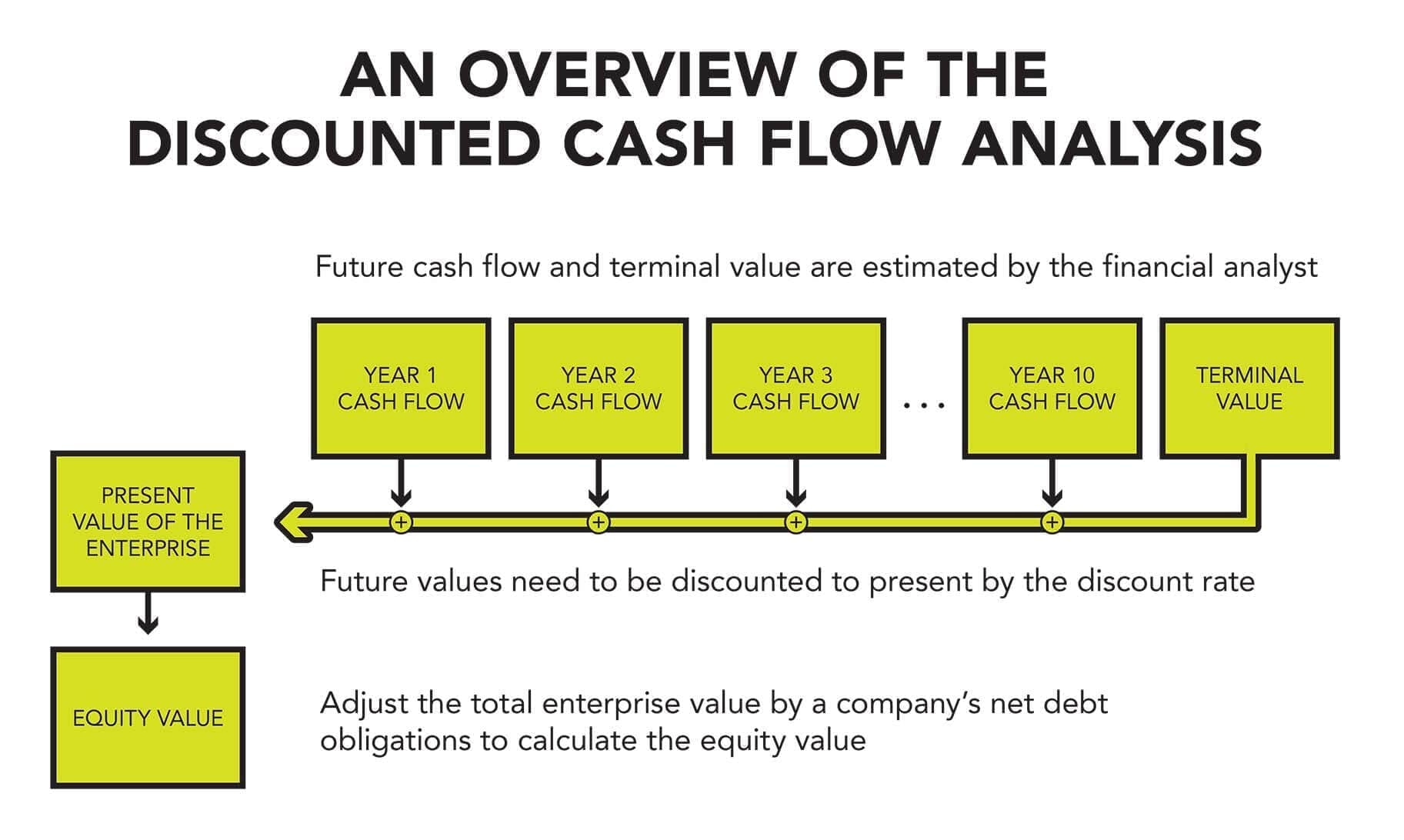

The first step is to create an estimate of a business’s future cash flows.

This mandates some basic knowledge of the business in order to understand its future growth rate, profit margins, and investment needs. An analyst will generally estimate five to ten years of a business’s future cash flows.

Cash flow tomorrow is worth less than cash flow today, because cash today can be reinvested for a return; this concept is referred to as the time value of money.

Therefore, to determine the present value of a business, the cash flows need to be discounted to the present by a discount rate.

The most commonly used discount rate is the weighted average cost of capital (WACC) which takes into account a business’s cost of capital.

Step 2

Next, a terminal value needs to be calculated.

The terminal value is what the business could be worth following the last year of projected cash flow in the analysis.

There are two ways of calculating the terminal value: the perpetuity growth method and the exit multiple method. Once assessed, the terminal value must also be discounted to the present.

You can learn more about calculating a terminal value here.

Step 3

Finally, all the cash flows and the terminal value that have been discounted to the present are added up.

The sum of these values should approximate the enterprise value of the company, which is the total value of the company including its equity and debt capital.

To determine a company’s equity value, reduce the terminal value by the company’s net debt obligations. To get to a per-share equity value, divide the equity value by the company’s total shares outstanding.

The image below illustrates the many steps in a discounted cash flow analysis.

DCF Analysis: Pros and Cons

The discounted cash flow analysis is widely used by professionals in the field of finance.

It is seen as the gold standard for calculating the intrinsic value of a business because it uses cash flows, which are considered a more reliable metric than other forms of corporate earnings.

Furthermore, the DCF analysis adjusts for changes in a business that may occur in the future.

Even though the DCF analysis is widely seen as the benchmark for valuation analysis, it has some drawbacks—most notably, the analysis requires making several assumptions and is highly sensitive to those assumptions.

An analyst not only needs to estimate a business’s future cash flows (no trivial matter) but also must make assumptions about the terminal value and discount rate. There is a lot of room for error, and thus DCF analyses are often seen as approximate estimates rather than precise calculations.

[optin-monster-shortcode id="lpksguplrq6xzsmlsqgw"]

Related Terms

Sorry, we couldn't find any posts. Please try a different search.

Sorry, we couldn't find any posts. Please try a different search.

Featured Book